It’s tax season again, which means one thing: scammers who are posing as IRS agents are out to get you.

- Inbox Dollars - Get paid to check your email. $5 bonus just for signing up!

- Survey Junkie - The #1 survey site that doesn't suck. Short surveys, high payouts, simply the best.

- Nielsen - Download their app and get paid $50!

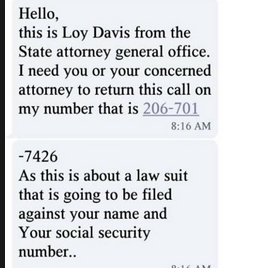

The scam might occur as a voicemail left on your system, where you are warned that legal action is about to taken against you unless you call back and/or pay your taxes immediately.

The scam might also occur through text message, where you are told where to send payment after clicking on a provided link or opening an enclosed attachment.

Don’t do it.

The Erroneous Refund

There is a new tax scam going around this year. It seems that thieves are hacking into the office’s of tax professionals, stealing your personal information, and then filing a fraudulent return in your name.

To the IRS, it looks as if you have personally filed your taxes, so the issue a refund, even though it’s fraudulent.

Now, the scammer has your personal information and will contact you directly, claiming to be from the IRS. They will demand that you return the money.

However, the scammer will have you return the money to them and not the IRS. Leaving you with a fraudulent return filed in your name and in-debt to the IRS for a few thousand dollars.

How to protect yourself

Let’s start with the basics: don’t cash any checks that show up unexpectedly.

If the return was directly deposited into your account, head to the bank and ask to speak with a manager.

For the love of God, do NOT, under any circumstances, mail a money order off to an unknown source.

Finally, and most importantly, call the IRS directly at 1-800-829-1040 (if you are an individual) or 1-800-829-4933 (if you are a business) and tell them you have been a victim of a fraudulent tax return.

Read up on how to best protect yourself from tax based identity theft.

The real IRS tax delinquency process

On the IRS website, you can learn just how the IRS reaches out to delinquent taxpayers. This occurs through a formalized process that never involves unsolicited phone calls or threats of legal action. In fact, the IRS acknowledges that taxpayers have rights, including the rights to privacy and to appeal.

How does the IRS correspond with delinquent taxpayers?

The IRS does not call you.

The IRS sends a formal letter stating how much money is owed per each tax year. In most cases, separate letters are sent for each year of delinquency, going back up to seven years in time.

Each delinquency is assigned a notice (CP) or letter (LTR) number at its top or the bottom right-hand corner. These numbers can be searched by going to the IRS home page.

Taxpayers are notified that they can appeal the amount of money they have been assessed. Taxpayers are encouraged to pay as much as they can, but they are never told they must pay the entire amount immediately, or that non-payment will result in their arrest or a lawsuit.

Should a taxpayer agree to make payment, the IRS provides a payment page with more information. On this secure page, taxpayers can pay via their bank account or credit/debit card. There are other options listed as well, including paying with cash.

More importantly, for taxpayers who have encountered dire financial circumstances, there are several partial payment and delayed payment options available. Those options include making monthly installments, submitting an offer-in-compromise, and even delaying payment altogether.

Such alternatives can be a lifesaver if you’ve recently lost your business, for example, and simply don’t have the needed profits to make payment on your taxes. Similarly, if you’re a freelancer who has gotten behind on your quarterlies, paying your taxes in monthly installments can stop interest and/or penalties from accumulating.

The IRS Phone Call Scam

The IRS scam tax delinquency “process”

In contrast to the IRS, scammers rely on fear and misinformation to coerce taxpayers into paying their taxes right away, and without knowing the full extent of their rights or appeal options. Scammers also use different means to trick taxpayers into paying the full amount they owe, including the following:

Phone calls: IRS scammers will often robocall recipients, telling them that they must respond immediately or face a lawsuit. One such robocall call might go as follows:

No joke. Here are the fastest ways to make easy money online. Click here to see how.

This a final notice from IRS, Internal Revenue Service, which is filing a lawsuit against you. For more information, please call immediately to XXX-XXX-XXXX. Thank you.

When would-be victims return calls made by these robocallers, they’re often connected with individuals with very thick foreign accents. Sometimes, the scammers try to have their victims purchase gift vouchers and provide the ID numbers of those vouchers over the phone. Recently, a bunch of these scammers were discovered and found to be working at an Indian call center.

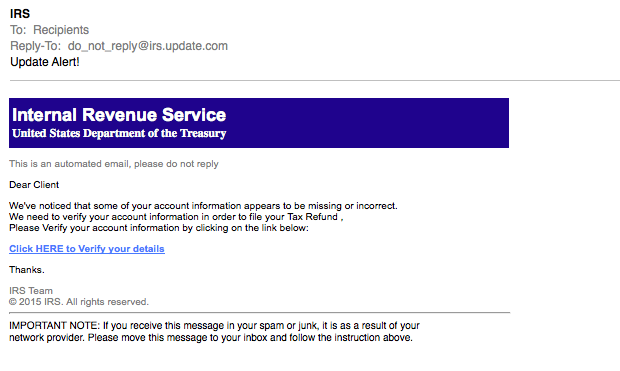

Emails/letters: IRS scammers may also send out emails or letters, supposedly from the IRS, that even contain case and/or letter numbers and threaten the recipient with legal or criminal prosecution if payment is not made immediately. The fraudulent letters are usually superimposed onto legitimate letters from the IRS that were collected from office trash receptacles or other refuse (one more reason to shred/burn your sensitive documents).

When the victim clicks on a link provided in the email, oftentimes a phishing page boots up and steals the victim’s sensitive information such as Social Security number, credit card number, etc. The IRS warns about identity theft via phishing on its website. Alternately, a malware program infects the victim’s computer.

Texts: Some individuals have even reported receiving bogus texts from the IRS. The messages state that legal and/or court action will be taken against the recipient unless he pays the owed money immediately.

Requests for money: IRS scammers next ask that recipients of their calls, emails, letters and texts send money. However, the money is to be sent by wire transfer or through the purchase of MoneyPak or Green Dot prepaid cards. In some cases, scammers have requested that their hapless victims purchase gift cards and just read off the back codes to them.

The government is never going to accept gift cards over cash, and this is noted on the IRS payments page as well. Likewise, the IRS will offer installment payment plans if the taxpayer cannot pay the entire sum by a given date.

What should you do if you are a victim of an IRS scam?

Unfortunately, many individuals are conned every year and end up losing thousands of dollars to IRS scammers. What should you do if you suspect that you’re a victim of fraud?

First of all, contact the Treasury Inspector General for Tax Administration (TIGTA) via the IRS Impersonation Scam Reporting page.

Also, contact the Federal Trade Commission using the FTC Complaint Assistant on FTC.gov.

When working with the IRS on owed taxes, use the IRS.gov site exclusively. Also, make sure that you are not dealing with an IRS subdomain (irs.scammerssite.gov) by checking if your pages all end in irs.gov.

If you have any doubts about your case, call the IRS directly. Their agents work with people directly on the phone. Agents are more than willing to help you sort through your tax questions, and can even provide you with lots of money-saving advice.

Wow there are a lot of ways they try to scam you. It would be hard to know if it was a scammer or the actual IRS calling you even if it was legit! Usually, they tend to leave something that seems a little odd, though. I think the best thing to do is anytime you get a call to Google the number and you can get instant feedback on that number. If it’s actually from the IRS you should be able to find it.

Hello Steve

Reading your post on scams and scammers just made me laugh at how we can sometimes be caught off guard or be plain stupid.

Anyone who has ever paid income tax I will think should be wise enough to know that the IRS will never ask anyone to pay through gift cards.(your line of reading the gift card barcode to scammers made me really laugh)I`d think that anyone will be able to tell something is wrong there.

I think scams are still very active because people affected are sometimes shocked and too ashamed at having been so stupid that they do not report the matter.One will think, “ok I was stupid, but they only took $100,$200 or whatever so I have to accept the loss” and this keeps the scammers in business, a few hundred here and there is all they need.

This is how I justified it when I got scammed online, I could not believe I had been st stupid and felt too ashamed to mention it to anyone,I just accepted my loss but thinking of it now, accepting such a defeat is what keep these guys in business.

Really informative, thanks for sharing.

A lot of these scams tend to target the elderly as well who just don’t know any better. They can also be extremely aggressive. People fear the IRS and now you have a guy claiming to work for them threatening to take away your house and you do what they say. It’s really unfortunate.

Steve,

I’ve been concerned about these IRS scam for awhile due to its scheme getting more sophisticated these days.

On Youtube, there’s a few guys who posted their videos of spotting the scammers and they try to waste the scammers’ time as much as possible. Usually those scammers ask for Target Gift Card or any kind of other store card.

However, it’s getting more common that a few of these scammers get a way to even use money order, scamming people to send these money orders to a central location and collect the money later.

Thanks for the informative post !

Great info. This is something that people should take serious because scammers are getting better and better at this stuff.

As technology grows, so do the people who try to take advantage of it.

Don’t ever give out any personal information over the phone.

This was a good read, prior to finishing up my taxes.

Thanks.

Glad to help Derick!

I heard few stories how scammers convinced people who do not talk in a proper English well to give them money for fake services.

Sometimes scammers look for people who do not have documents and are illegally in the country.

You are right that IRS never calls. Usually IRS sends a letter. Here people can find a reason why somebody from IRS wants to hear from the particular person.

All the best, Nemira.

Right, if the IRS wants to reach you, they will mail you a letter. You can always call them yourself and ask them to verify any documents you may have received.