Recently, I received the following email in my inbox from a person praising the Paid2Save app:

You recently filled out a request to be matched with a business opportunity and I am THRILLED to be able to share this information with you!! You have come across an INCREDIBLE opportunity at the RIGHT time!!

Paid2Save is an incredible, innovative Mobile Technology Company. There are fascinating things happening as we speak! This is a HUGE opportunity to make money on your own terms and this is a ground floor opportunity!

I’m always leery of companies or associates advertising massive “opportunities,” complete with lots of exclamation points. So, I decided to dig further into the Paid2Save business opportunity.

What is Paid2Save?

Paid2Save is both the name of a company and a mobile app that has existed since 2012. The company is based in California and is owned by David Hart of Hart 2 Hart Marketing. The app is a downloadable piece of software that customers use to get discounts to local merchants. As such, the app works akin to the business structures of LivingSocial and Groupon.

Unlike LivingSocial and Groupon, however, Paid2Save has a grand total of one employee, which might be David Hart himself or Linda Hart (data derived from Hoover’s).

Where does the rest of the workforce originate from?

Welcome to the world of MLM

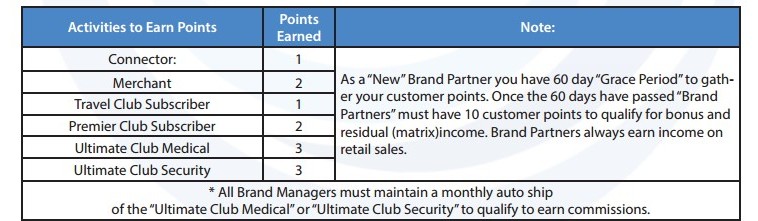

Paid2Save operates via a referral structure of brand associates who work to recruit new merchants as well as app users. In order to become a brand associate, you purchase either the Business Starter Pack for $199.90 or the Business Builders Pack for $399.90.

Both of these plans provide you with an Ultimate Club Membership, enabling you to qualify for discounts at local merchants like dentists, restaurants, movie theaters, etc. You also obtain one or more DreamShares, which is like timeshare ownership.

You also qualify to earn income via retail sales and recruitment of new members. In fact, if you fail to recruit others into the program, you will no longer receive bonus and residual income.

This means you’ll soon be bugging local businesses and your family and friends to download the Paid2Save app or sign up for its different membership plans.

These plans cost $14.95, $29.95, or $49.95 per month for the Travel, Premier or Ultimate Club subscriptions, respectively. There is also a one-time $9.95 application fee.

As you sign up new members, you will start to build what’s known as your “downline.” This downline will kick up some of their member subscription commissions to you once they recruit their own new members. You will then rise up in the ranks of the organization and earn a new title (e.g., Brand Partner, Brand Supervisor) plus additional bonuses and commissions.

Is the Paid2Save app worth it?

While I’m not a big fan of MLM-style businesses, my bigger hesitation with Paid2Save is the product itself and how it can realistically make money for the company and its brand associates.

Paid2Save is not a real product.

Companies make revenues on actual products, not access to discounts from third-party vendors. This is one big reason why Groupon has struggled for years to make actual revenue and maintain solvency.

Sure, the app does make money via merchant transactions- 10% of each merchant transaction is paid back to Paid2Save. But a merchant will typically run a promotional discount once or twice a year, not constantly. Also, many merchants will cancel their plans after they’ve promoted their business and/or found the app to be unprofitable.

Paid2Save faces stiff competition.

LivingSocial and Groupon are free to use for customers and it’s only the merchants who must pay for the services. Many online discount and daily deal sites are free to use. It’s going to be difficult to convince frugal shoppers to pay up to $50/month for discounts that they could otherwise find for free, even if those discounts are really good.

Paid2Save has MLM competitors.

Even in the world of MLM, the Paid2Save app is not alone. Similarly styled apps like FlexCom, Lyoness and BeepXtra also operate by recruiting members and offering access to discounts as their product. ZeekRewards is yet another such MLM-based app, which is now undergoing litigation for being an illegal Ponzi and pyramid scheme.

You must pay for a membership.

As you move up the Paid2Save ranks to brand manager, you must also pay for an Ultimate Club subscription. That’s a business cost of almost $50/month just for being able to recruit new associates and collect a portion of their commissions.

The deals just aren’t that good.

After I downloaded the Paid2Save app and checked out its deals, I saw the usual merchant discounts that I would also find via Ebates, TopCashBack, etc. For example, I found online deals for 1.2% cash back from 1-800-BASKETS and 4% cash back from 1-800-FLORALS.

In the local deals area, I found a Pay $20, Get $30 Worth of Food/Beverage deal at a golf center and a free evaluation offer at a chiropractic center. These are the same kinds of deals that I see in my mailbox circular.

The Paid2Save Bottom Line

The Paid2Save app might be a worthwhile app to have at your disposal when you are shopping or out on the town. However, because customers must pay to use this app’s bigger benefits (through paid Club subscription plans), there is going to be limited product interest even if the discounts are good.

My recommendation is to keep clear of this business opportunity and look elsewhere.