In a nutshell: car wrap scams are a type of fake check scams.

- Inbox Dollars - Get paid to check your email. $5 bonus just for signing up!

- Survey Junkie - The #1 survey site that doesn't suck. Short surveys, high payouts, simply the best.

- Nielsen - Download their app and get paid $50!

I first wrote about this scam back in 2013 and it’s almost 10 years later and still going strong.

This post alone has over 1,000 comments from people I’ve helped and countless more have written to me privately. I’ve saved tens of millions of dollars from falling into scammers hands.

If you aren’t careful, it can cost you thousands of dollars.

In fact, a study by the FTC showed that people reported a median loss of $1,988 in 2019 to fake check scams, including car wrap scams (Source)

Today, I’ll explain what a car wrap scam is, how to spot one, and relay my own personal experience with this scam, complete with photos.

How Do Car Wrap Scams Work?

As I’ve mentioned, car wrap scams are a type of fake check scams.

Generally, here’s how a fake check scam works:

1. Scammers get in contact with you.

Scammers get your information while you’re looking for a legitimate work from home job and reach out with a job offer.

Or maybe you end up contacting them because you saw an ad to “get paid to drive,” “mystery shopper wanted,” or “virtual assistant wanted.”

Others tell you that you’ve won a sweepstakes, even though you don’t remember ever buying a ticket or entering a contest.

2. They send you a fake check.

Once the scammer is talking to you, they send you a genuine-looking check. These checks look genuine enough to fool you and bank tellers.

Car wrap scammers will send you a check for a greater amount than they agreed to pay you. They’ll then tell you to deposit the check and send the graphic designers or car wrap service the rest of the amount so they can come and wrap your car.

Mystery shopping scammers will assign you to evaluate the services of a money transfer service or money order retailers, and sometimes gift card retailers. They’ll then send you a check to deposit it in your personal account and then wire the money to someone else or buy gift cards in that amount and send the codes to them.

Virtual or personal assistant scammers send you a check and then instruct you to buy gift cards for supplies for your clients and then send them the codes.

Sweepstakes scammers send you a huge check and then instruct you to wire them a certain percentage for taxes, handling fees, or processing fees.

3. You deposit the fake check.

When you make a check deposit, banks are legally required to make the funds available for you to withdraw immediately.

So you withdraw the funds and send the money to someone else or buy the gift cards, etc.

It all seems fuss-free and above board, right?

Wrong.

4. The check bounces.

It can take days or even weeks to uncover a fake check.

Once it’s uncovered, the check bounces and the bank takes back the money from your account.

But you’ve already sent thousands of your own dollars to the criminals!

No joke. Here are the fastest ways to make easy money online. Click here to see how.

And they’ve vanished by this time. No way to contact them, no way to get the gift card codes back.

So you’re on the hook for the money, and now you have to explain to your bank why you even deposited a fake check into your account in the first place. You’re out the overdraft fees as well if you don’t have enough to cover the money that the bank took back.

This post was originally published in 2013. This scam is STILL occurring today and it looks like it will continue well into the future.

In fact, car wrap scams are now even more dangerous as the people behind them are coming up with more convincing ways to trick people into losing their hard-earned money.

For instance, some of the brands they claim to work with include ROCKSTAR Energy Drink®, Monster Energy Drink, Aquafina, Pirelli Tyres, McCafe, Dunkin’ Donuts, Langers Juice Company, Dr. Pepper, Marlboro, Purell, and many other big names.

Keep reading to see my experience with this scam and if you have received an email that you think might be sketchy, please post it in the comments below.

Can I cash the fake check?

The very first question I get asked is: “Can’t I just take the fake check to one of those check cashing places and keep the money?”

The answer is a hard no.

Check cashing facilities do not hand out money anonymously. You need to provide them with your identity, proof of residence, proof of employment, phone number, address, and so on. Even if they do manage to cash the check for you, the check will bounce and now they know how to get in contact with you.

They will start off by calling you, then mailing a certified letter, then they will escalate it and get the authorities involved. If you do not respond to their attempts to contact you, you can expect a warrant to be placed for your arrest by the authorities.

How to Spot, Avoid, and Report a Car Wrap Scam

So, knowing all these, what can you do to protect yourself from being scammed?

Take note of the following information:

1. Know how legitimate car wrap companies operate.

Actual car wrap companies do exist, such as Carvertise, Wrapify, Nickelytics, and My Free Car.

The main thing is that normally drivers come to them, not the other way around. They typically evaluate drivers based on how many miles they drive, where they drive, and their driving record.

They typically cover the cost of the wrapping themselves, too.

So if you do receive an email asking if you’re interested in having your car wrapped and getting paid hundreds of dollars a week, and you know you haven’t contacted or applied to a car wrapping company, ignore it. That’s likely a car wrap scam.

Most importantly, the amount on the check they’ll send you is exactly for the agreed amount, if they even pay you by check. Carvertise, for instance, pays you via direct deposit.

2. Never deposit checks from people you don’t know.

Sometimes it can be that simple.

Got a check in the mail from a stranger? Put it down and report it (see how below).

You can make money from home and it doesn't have to be challenging. Click here to see how.

3. Never use money from a check to buy gift cards, money orders, or wire money to third parties.

This applies even if you were written a check by someone you know.

If you buy gift cards and send the codes, or wire money, that’s like giving someone cash. You’re never going to get that money back.

Plus, what legitimate company wants you to send them digital gift cards? This alone doesn’t pass the sniff test.

4. If you receive a suspicious check, report it immediately.

Help yourself and other potential victims by reporting it to the following:

- Federal Trade Commission

- US Postal Inspection Service (under mail fraud)

- Attorney General

So what should you do when a scammer wants you to cash a fake check?

Here’s my personal experience with these car wrap scammers:

The Car Wrap Scam

In mid-September, I received an email from “David Christian” that originated from the address patriciabarrington@hotmail.com. The email simply said the following: Would You Wrap Your Car in an Ad for $300 Weekly? After I answered “yes,” I received the following email back:

Hello,

Wrap advertising is the marketing practice of completely or partially covering (wrapping) a vehicle in an advertisement or livery, thus turning it into a mobile billboard. This can be achieved by simply painting the vehicle surface, but it is becoming more common today to use large vinyl sheets as decals. These can be removed with relative ease, making it much less expensive to change from one advertisement to another. Vehicles with large, flat surfaces, such as buses and light-rail carriages, are fairly easy to work with, though smaller cars with curved surfaces can also be wrapped in this manner. Wrap advertising is available to anybody irrespective of the vehicle you drive.

We are currently seeking to employ individuals in the United States of America. How would you like to make money by simply driving your car or banner wrapped for ROCKSTAR Energy Drink®

How it works?

Here’s the basic premise of the “paid to drive” concept: ROCKSTAR Energy Drink® seek residents in the United States who are professional drivers to go about their normal routine as they usually do, only with a big advert for “ROCKSTAR Energy Drink®” plastered on your car. The ads are typically vinyl decals, also known as “auto wraps,”that almost seem to be painted on the vehicle, and which will cover any portion of your car’s exterior surface.Don’t Have a Car?

If you don’t have a car, you can also participate if you have a bike.What does the company get out of this type of ad strategy?

Lots of exposure and awareness. The auto wraps tend to be colorful, eye-catching and attract lots of attention. Plus, it’s a form of advertising with a captive audience,meaning people who are stuck in traffic can’t avoid seeing the wrapped car alongside them. This program will last for 3 months and the minimum you can participate is a month.What is the Contract Duration?

Once the wrap has been installed, minimum term is 4 weeks and maximum is 12 weeks.Would the wrap/decal damage the paint of my car?

The decal doesn’t damage the paint of car and will be removed by our representative once the contract expire. We will be responsible for installation and removal of the wrap.You will be compensated with $300.00 per week which is essentially a “rental”payment for letting our company use the space and no fee is required from you. ROCKSTAR Energy Drink® shall provide experts that would handle the advert placing on your car. You will receive an upfront payment of $300.00 in form of a check via courier service for accepting to carry this advert on your car.

It is very easy and simple no application fees required. Get back with the following details if you are interested in this offer.

Applicant information:

Name :

Full Street Address(not PO BOX) :

APT #:

City,State,Zip Code:

Cell Phone Number:

Home Phone Number:

Age:We shall be contacting you as soon as we receive this information.

Best Regards,

David Christian

Hiring Manager,

ROCKSTAR Energy Drink®

I provided my contact information, after which I received the following email:

Thank you for your swift response and your willingness to work with us. To this effect, you are advise to check your email regularly to get updates as to know when your upfront payment will arrive at your address.

1) You will receive a Check as a form of payment. As soon as you get the check, you will cash it for the decal wrapping on your car and deduct $300.00 as your up-front payment. The rest of the funds from that same check should be transferred to the Graphic artist that will wrap the decal on your vehicle. All you need is to confirm the acceptance and understanding of this email.

2) You will make a transfer of the remaining funds to the Graphic artist via wire transfer at an outlet in your area, the Info which you will make the transfer to will be emailed to you soon.

3) We’ll like you to confirm Information about your vehicle as below:

i) Type of Car and Color :

ii) Model/Year :

iii) Present Condition and the Mileage:

Note: Please, confirm that you did receive this message so that we can process funds that would be sent to you for the car advert.

All other instructions will be sent out to you asap.

I…………..Confirm to have received this email and understand the content.

Best Regards,

David Christian

Hiring Manager,

ROCKSTAR Energy Drink®

The Fake Check Arrives

I confirmed my willingness to work with “ROCKSTAR Energy Drink.” About a week later, I started receiving text messages on my phone from David Christian regarding my upcoming “check”.

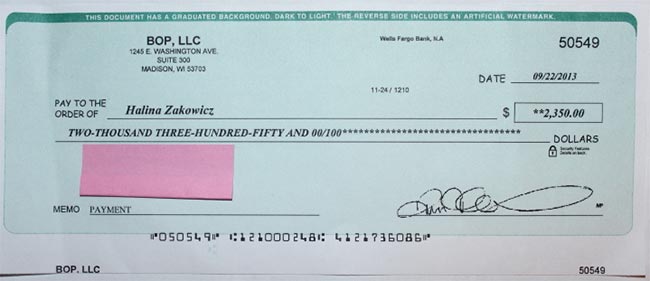

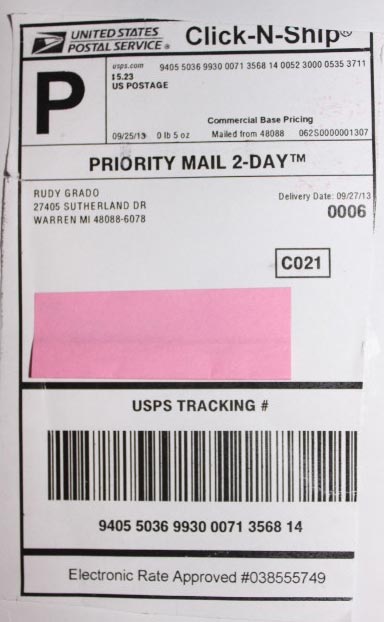

Sure enough, when I went home and opened my mailbox, I found a check made out to me in the amount of $2,350. Woo hoo!

Interestingly, the check was made to look like it was coming from BOP, LLC, a legitimate clothing store business here in Madison, Wisconsin. The envelope, however, had a copy of a USPS Priority Mail 2-Day slip on it in which Rudy Grado, at 27405 Sutherland Drive, Warren, MI 48088-6078, was noted as the sender. I took pictures of both the fake check and the envelope it came in and have provided these pictures below. The pink stickies were affixed by me to hide my home address.

I called BOP, LLC and told them that I had received a check from them for the amount of $2,350. The business immediately asked me if my check was blue. I said no; it was actually a green color. The store immediately informed me that the check was fake and I should talk with law enforcement.

Meanwhile, I had David Christian texting me at least twice that day and asking me if I’d received my instructions on what to do with the check. I texted “him” back that I had yet to receive any emailed instructions. Naturally, when I later checked my email I found the following message:

Hello Halina,

Kindly proceed and deposit the check into your bank account and funds will be available for withdrawal 24hrs after it has been deposited. I will be waiting for a confirmation message immediately the check is deposited.

As soon as the cash is out you are to deduct $300.00 which is your upfront payment and forward the balance ($2,050.00) to the graphic artist that will be wrapping the decal on your vehicle via Money Gram and they will also be responsible for removing the decal when the program is completed. Please visit www.moneygram.com to check agent location close to you and make transfer through them.

Below is the name of the receiver. Please note that the transfer charges should be deducted from the remaining $2,050. You are to get back to me with the transfer details (Reference Number and the exact amount sent).

Below is the Graphic Artist Money Gram details to send the Money to

Receiver’s Information:

Name: Sandra Fagan

City: Jacksonville

State: FL

Zip Code: 32210Kindly get back with the information below once the transfer has been completed.

Reference Number & Total Amount Sent

FAQ: Why am I sending money to Florida? The head office of the graphic artist is in FL.

As soon as payment is acknowledged by them, a local artist in your area will be sent to your address to install the decal wrap on your car. Let me know as soon as the check is deposited today.

If you require additional information, do not hesitate to email or call me.

Best regards,

David Christian

Hiring Manager.

(702)605-0985

What do you think I should do?

At this point in time, I’m debating about taking several different courses of action. I could do the following:

1. Contact local law enforcement and tell them that Patricia Barrington, Sandra Fagan and Rudy Grado are writing fake checks in a legitimate Madison business’ name.

2. Contact the FBI about the same issue since it spans several states (i.e., Michigan, Wisconsin, Nevada and Florida).

3. Tell the scammers that I’ve deposited the check and am waiting for it to clear. This puts the car wrap scammers in a holding pattern because checks typically take 1-2 weeks to clear.

4. Tell the scammers that their “employment” check has been forwarded to the IRS for cashing because I owe back taxes and all my earnings must first be garnished (That should put them into a panic!).

5. New development! I might have a second car wrap scam check coming to my house very soon. This one is from George Jennings of NOS Energy Drink. Should I tell the ROCKSTAR scam folks that I’ve instead decided to work with the NOS scam folks- or vice versa?

I’ve Tried That readers, what would you do in this situation?

Update as of October 7, 2013:

First off all, thank you everyone for your feedback! I was feeling a little confrontational this morning, so I decided to first text David Christian and say that I’d deposited the check last Friday at my bank. Within seconds, I received a text message back from him, asking if I’d received my email instructions.

Deciding to not play text tag any longer, I called Mr. David Christian at the phone number (702) 605-0985. A guy with a slight English accent picked up the line and actually identified himself as David Christian. I told him that I’d deposited the check I’d been sent last Friday, but the bank had put a hold on it for some reason. He asked me how long the hold was. I answered that the bank wanted to hold it for two weeks.

David didn’t seem too concerned about the hold and said that I could just wait until the check cleared, then write out my own check to the graphic artist.

I then asked David about the Madison business that had been listed on the check (BOP, LLC). I said I was confused about why this business was being listed on the check. David answered that this business was the sponsor.

I then told David that I had contacted this business and they had no idea what I was talking about. BOP had also told me that the check was the wrong color (their checks have a blue background).

At that point, David and I lost connection. I tried calling him back at least two times. No answer. I wonder what happened. I hope he’s OK…

Update as of October 12, 2013:

This past week, I received the following email from a “George Jennings (george.jennings11@outlook.com)” of NOS Energy drink:

Hello Halina,

Information reaching me this morning has it that you will be receiving the check today. The check of $2,330.00 has been sent to you via USPS with tracking number (9405501699320009816575) and it will be delivered to you this morning. Kindly proceed and deposit the check into your bank account and funds will be available for withdrawal 24hrs after it has been deposited.

I will be waiting for a confirmation message immediately the check is deposited. As soon as the cash is out you are to deduct $300.00 which is your upfront payment and forward the balance ($2,030.00) to the graphic artist that will be wrapping the decal on your car via Money Gram.

They also will be responsible in removing the decal when the program is completed.

Below is the name of the receiver. You are to get back to me with the transfer information (8 digits Money Gram Reference) Number and the exact amount sent). You are to deduct the transfer charges ($180.00) from the $2,030.00 you have with you.

Below is the Graphic Artist Money Gram Details to send the Money to in Minutes

PAYMENT INFO

Name: Constance H Lawson

City: Saint Johnsbury

State: Vermont

Zip code: 05819Kindly get back with the information below once the transfer has been completed.

Money Gram Reference Number# & Total Amount Sent

FAQ: Why am I sending money to Vermont? The head office the graphic artist is VT, As soon as payment is acknowledge by them, a local artist will come to your house and install the decal wrap on your car. Let me know as soon as the check is deposited.

If you require additional information, do not hesitate to email me or call me.

Best Regards

George Jennings.

951-234-7388

Hiring Manager.

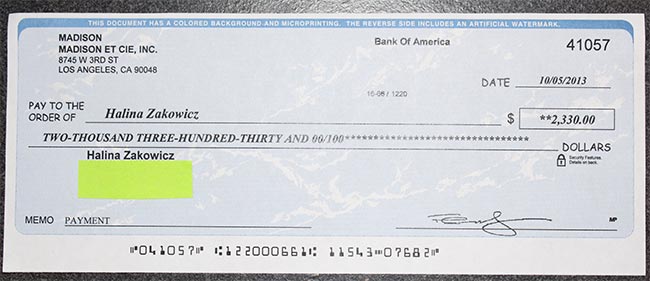

And here’s the fake check:

I’m seeing at least one common theme between the NOS and ROCKSTAR Energy Drink scammers. First of all, the car wrap “sponsors” are both clothing shops, BOP (of Madison, WI) and Madison et Cie (of Los Angeles, CA). What a clothing shop has to do with an energy drink, I haven’t a clue.

I also think that the NOS scam artists are far more sloppy than the ROCKSTAR Energy Drink scam artists; why would an LA-based shop sponsor a car in Madison? Unless that shop was picked only because it has the name “Madison” in it- did the scammers think I wouldn’t notice the location of this “Madison”-based shop?

Update as of October 15, 2013:

So, apparently, I don’t have to be scammed for $1,850 ($2,030 – $180 for wire transfer charges). I can also be scammed for just…get ready for it…$1,000!

Hello Applicant,

You are receiving this email because you applied for car wrap job. We are please to inform you that your application has been processed. Payment has been sent and delivered which include your 1st week payment and funds for the graphic artist. We will like to have an update from you if you have been able to forward fund to your matched graphic artist head office. If yes, provide the transfer info and If you are yet to receive payment from us, please let us know so we can process your application immediately. We look forward to your swift response.

Regards

George Jennings

My reply (including all broken grammar and misspellings): Thank you for email. My bank deposited the check but tell me I will receive back only one thousand dollars from thsi check. I don’t understand why.

George Jennings: Why is that? What did the bank say?

My reply: The bank is saying that the IRS is going to garnish my check as wages. I’m supposed to send them a W-9 from NOS too. Can you send a W-9 for these wages?

George Jennings: All the necessary document will be presented to you before the installation. Kindly proceed to send the $1000 via Western union to Constance to enable us book the installation appointment and the graphic artist will bring the W-9 with him. I will be expecting the Western union details.

Update as of October 18, 2013:

My saga with George Jennings continues:

Me: What about the $200 wire transfer charge?

GJ: The transfer charges should be deducted from the $1000. Kindly try and get this done today so the appointment can be booked.

Me: I sent a check this afternoon to the graphic artist. Thanks!

GJ: To who? You are to make a western union transfer to the details that was sent to you. Not send a check besides no address was provided to you.

Me: To Constance H. Lawson. She lives on Railroad St. in Saint Johnsburg, VT. It was much cheaper for me to just send a check.

GJ: Call it back.

Me: I already sent the check to her, but I can call her phone number and let her know not to cash the check. Or, should I send payment to the following address: PO Box 4125 Saint Johnsbury, VT 05819-4125

At this point, George stopped answering my emails. Too bad…

The Bottom Line: Avoid Car Wrap Job Offers

At best, responding to these scammers will waste your time. At worst, it could cost you thousands of dollars, financial ruin, and get you in trouble with the authorities.

Avoid any offered car wrap jobs, ignore the people behind them, and always do your research.

However, since you’re here reading this, you’re no doubt interested in finding new ways to make some extra money.

Recommended Resources

- Get Paid to Drive

- Secret Shopper Jobs

- Virtual Assistant Jobs

- Legitimate Work from Home Jobs

- Side Hustles That Make Money

- Online Business Ideas

- 20 Ways to Make Money with Your Phone

I hope this post helped you avoid a scam and find a legitimate opportunity to pursue.

Please leave a comment below if you’ve ever had a run-in with one of these scammers. Every comment helps!

+My name is Daniel Vasquez

I just received an offer from Poland Spring Water theyre offering $5500 check for car wrap advertising.The say Ill be payed $1000per week after I agree to pay the guy installing the wrap .They said they ll send a check in the next two days and duct my share of the money and foward the rest to who knows where or to who .Im waiting for the check to arrive and further instructioms Im not going to deposit the check I ve being rhinking of calling the law on this scammers.I went and visited the Poland Spring Water website and thats where theyre offering the advertisement offer. Check it out to see the application form.Keep you posted

What to do if I already put the check in my bank account?

I just recieved a check for 2750.55 from Bank of Romney 105 North High Street Romney, WV 26757 it also has JUST PAWN IT POB 54 Capon Bridge, WV 26711. Im supposed to text Jefferson Bruner (315)203-2196 or (845)557-7435 and he will verify the check, but im not supposed to do anything till i hear from MR Bruner, im to text him my name the check amount check number. And if i submit my confirmation of deposit within 24 hrs i will recieve an extra $150 amazon gift vou posted to my address . They stress not to do anything until i text the info they asked for , and. I hear from Mr.Jefferson Bruner….ya ok hang on lmfao

I received a check from Rock Star Energy Drink for car wrapping from Randy Sims for the amount of $4,950 was told to deposit it in my bank and once it cleared for me to take out $700.00 for my 1st week payment and then I would have to send $ 4,250.00 to the Decal Installer for materials and there work fee and the specialists will come along with the agreement form which I’m required to sign and then after the 6 weeks of advertising the specialist would come and remove it off my car and if I had any question send a text to 909 281 0321..I’m suppose to text Randy Sims and let him know i received it and send him the check number for confirmation along with my name the amount ..You would think he already had all that information but it never was said how to send to the car wrap specialist.and I’ve gotten 4 text messages from thus Randy Sims and not once said how to send to the car wrap guy.. so should I send him the information he’s wanting or do I not respond at all to him..the check is off of Ameris Bank company name and address on check is Hall Freedom Inc House out of Atlanta GA and that is a Rehab place and the address on the Envelope from post office is from Qold Coast Mall out of Ocean City MD and that address go’s to a 3 bdr2bth house only reason I know that is cause I looked up the addresses and phone number that is out if California so there’s 2 different addresses and 1 phone number .. That’s Crazy…to think I wouldn’t bother checking it out first… so I think I’m going to frame it and hang it on my wall with a sign that reads from a STUPID!! Rock Star Energy Car Wrap guy name Randy Sims for the amount $4,950.00. 👌

Well I received a check in the mail for car wrap and it a scam. The checks on Learning A-Z for 2,400.00 do not cash it if you have received one like this.

I just got a bunch of text messages from someone representing Poland Spring Water company to do the same thing. I got as far as them to say no thanks, I’ve changed my mind. I then get a text to advertise for Snapple. I deleted that one and reported it as junk asap. Be careful. If it’s too good to be true, it’s not!

Watch out on your phone from McCafe Drinks Wrap Advertiser. (904)294-2302 hiring Manager Thurston Alvina. $300-450 a week. Ask a lot of info on yourself, base on that he said he started a profile and needed ID.me to link up with profile. Next you get a message from IRS/ID.me stating a code to get in and verify. Which included your DL & SSN. After that is done , he said will send check to my address with further instructions. I said what does the IRS has to do with anything. He said to check if you owe any debts so they can add to the check. That’s where I think he was ahead of himself. I told him I don’t owe any debts to the IRS. Why would you do that…no reply just moving on to the next step. I think mainly they just wanted as much info about myself for identity theft. If they are thinking about obtaining loans good luck on them My Credit score is so low and have outstanding debts (i.e. credit cards, personal loans) plus I have my credit info on watch by all three credit info company’s.

I received a check from Tropicana Juice Wrap. Now they are texting me to confirm I am depositing the check. Thanks for this article, I knew something fishy about this. I’ll contact the FTC.

Cadbury chocolate killianmilletew@gmail.com no watermark on payment

Okay so Jack and Jill supposedly texted me saying was I still interested in there car wrap and I said yes they asked me for my driver’s license and social security number I told them I can’t do that because I’ve been scammed plenty of times before doing that and they said some ID me so that they can verify who I am in order to do this and that’s the only way that they can do it so I was trying to see if you knew anything about that

It is 100% a scam. Do not give them any of your personal information.

The monster energy car wrap $800 program is a scam gmb plastics 210 industrial Park drive Cummings Georgia 3 0040 is their address 234-956-0761 is one of the phone numbers Kelsie rose is the supposed relationship manager 267 796-6872 is the other phone number

I just received their check today for $4950.47. Then I read your review. Do I throw it away? Take it to the police? Play the game you did?

Obviously I’m not going to put it in the bank now, and I’m not paying anything for the purpose of advertising a product I don’t use. What do you suggest my next move should be?

Hang it on your fridge as a reminder of how you almost lost $4950.47. There’s not much else you can do with it really.

INFO ATTACHED

A new Marketing/Promotional Campaign was launched again for 2022 by “XYIENCE ENERGY DRINK” in order to promote itself in the market with the competition the company is facing presently with other brands. In the United States, “XYIENCE ENERGY DRINK” Group does not have a complete network of bottlers and distributors, so we decided to use this concept to gain more attention from consumers nationwide. Presently, “XYIENCE ENERGY DRINK” relies on its own bottling group to bottle and distribute its products in more than 30 states.

We are currently seeking to employ individual’s Nationwide, Regular citizens, Professional drivers to go about their normal daily routine as they usually drive around, only with a small advert for “XYIENCE ENERGY DRINK” plastered at the 2 EXTERIOR FRONT DOORS of your Vehicle. The advert is typically vinyl decals that almost seem to be painted on the vehicle, and which will cover any portion of your vehicle.

From this advert strategy, the company derives lots of exposure and awareness from doing this. The adverts tend to be colorful, eye-caching and attract lots of attention which people who are stuck in traffic can’t avoid seeing the wrapped Vehicle alongside them. Plus, it’s a form of advertising with a captive audience. This program will last for 16 weeks and the minimum you can participate is 10 weeks.

COMPENSATION/REWARD:

You will be compensated with $600 per week which is essentially a “RENTAL” payment for letting our company use the space & no fee is required from you (YOU DRIVE, WE PAY). “XYIENCE ENERGY DRINK” shall provide a specialist that will handle the advert placing on your car. You will receive an upfront payment in form of a Pay Check via Courier Service for accepting to carry this Advert on your Vehicle.

If you are interested, kindly reply with the following information to apply:

FULL NAME TO BE ON THE CHECK:

MAILING ADDRESS & APT. NUMBER:

CITY AND STATE:

PHONE NUMBER:

EMAIL:

MODEL/COLOR OF VEHICLE:

I’m so glad that I did a search on this. If I’m not mistaken, I’ve got a check sitting in the mail right now to have my car wrapped with “Miller Lite.” What is wrong with individuals these days? Ugh! Makes me sick! I would really like to see these people arrested for this crap. I wonder how many don’t search for these scams and end up paying tons of money out of their own pockets…very sad! Here’s all the information besides my personal info that I’ve received from this so-called company…

.

USPS Tracking®

Tracking FAQs

Track Another Package+

Track Packages

Anytime, Anywhere

Get the free Informed Delivery® feature to receive automated notifications on your packages

Learn More

Remove

Tracking Number: 9405649999689000880487

Your item was delivered in or at the mailbox at 12:06 pm on January 11, 2021 in

My city, state, and zip.

Status

Delivered

January 11, 2021 at 12:06 pm

Delivered, In/At Mailbox

My city, state, and zip

Get Updates

Delivered

Text & Email Updates

Tracking History

January 11, 2021, 12:06 pm

Delivered, In/At Mailbox

My city, state, and zip

Your item was delivered in or at the mailbox at 12:06 pm on January 11, 2021 in

My city, state, and zip

________________________________________

January 11, 2021, 10:18 am

Out for Delivery

My city, state, and zip

________________________________________

January 11, 2021, 5:17 am

Arrived at Post Office

My local post office

________________________________________

January 11, 2021, 4:16 am

Arrived at USPS Facility

KANSAS CITY, MO 64156

________________________________________

January 11, 2021, 3:48 am

Departed USPS Regional Facility

KANSAS CITY KS NETWORK DISTRIBUTION CENTER

________________________________________

January 10, 2021, 10:26 pm

Arrived at USPS Regional Facility

KANSAS CITY KS NETWORK DISTRIBUTION CENTER

________________________________________

January 10, 2021

In Transit to Next Facility

________________________________________

January 8, 2021, 11:47 pm

Arrived at USPS Regional Origin Facility

LOS ANGELES CA DISTRIBUTION CENTER

________________________________________

January 8, 2021, 10:32 pm

Accepted at USPS Regional Origin Facility

LOS ANGELES CA DISTRIBUTION CENTER

________________________________________

Product Information

See Less

Can’t find what you’re looking for?

Go to our FAQs section to find answers to your tracking questions.

FAQs

Shauna

________________________________________

Y35FV MILLER LITE VSP

________________________________________

VEHICLE WRAP Mon, Jan 11, 2021 at 1:40 PM

To: Shauna

Tracking Number: 9405649999689000880487

Your item was delivered in or at the mailbox at 12:06 pm on January 11, 2021 in

My city state and zip

Status

Delivered

January 11, 2021 at 12:06 pm

Delivered, In/At Mailbox

My city, state, and zip

________________________________________

From: VEHICLE WRAP

Sent: Monday, January 11, 2021 4:22 AM

To: Shauna

Subject: Re: Y35FV MILLER LITE VSP

This email is to notify you that the payment for the car wrap services which you applied will be delivered to you TODAY via USPS PRIORITY MAIL WITH TRACKING NUMBER:

9405649999689000880487

The MONEY ORDER is for $1780.10(SPINX INTERNATIONAL MONEY ORDER) and i will like you to act as instructed on how to go with the payment.

Kindly proceed to your bank to have the MONEY ORDER deposited as soon as you receive it. Funds will be available for withdrawal immediately or 24hours after it has been deposited. I will be waiting for a confirmation message once it has been deposited and state clearly when your bank indicated that funds would be available for withdrawal.

Send me a scan or snap copy of the deposit slip issued to you at the bank via email after you have deposited the check for record purpose.

You are to black out your account number on the deposit slip before it’s sent over to us.

Once you have withdrawn funds from your account i need you to do the following:

a. Deduct $300 which is your upfront weekly pay

b. We will then take you on the steps to have the funds sent to the decal specialist that will be responsible for the placing and the removal of the wrap(after the expiration of the contract)

You are to use the leftover funds to get Gas for running around

You have to confirm that you understand the content of this mail and also confirm when you receive the check package.

Waiting to have confirmation from you.

Acknowledge receipt of this email immediately ..

Best Regards

“STAY SAFE AND STAY CLEAN”

________________________________________

From: Shauna

Sent: Thursday, November 26, 2020 6:46 PM

To: VEHICLE WRAP

Subject: Re: Y35FV MILLER LITE VSP

Information requested…

My vehicle information removed

My name

My address

My city, state, and zip

If you need any other information please let me know.

On Wed, Nov 25, 2020, 7:39 AM VEHICLE WRAP wrote:

Hello,

Thank you for your swift response and your willingness to work with us. MOBILE advertising is the marketing practice of placing a logo on a vehicle thus turning it into a mobile billboard. This can be achieved by simply placing a logo on the surface of the vehicle, but it is becoming more common today to use vinyl sheets as decals because these can be removed with relative ease, making it much less expensive to change from one advertisement to another. Vehicles with large, flat surfaces, such as buses and light-rail carriages, are fairly easy to work with, though smaller cars with curved surfaces can also be wrapped in this manner. MOBILE ADVERTISING is available to anybody irrespective of the vehicle you drive.

We are currently seeking to employ individuals worldwide.

How it works?

Here’s the basic premise of the “paid to drive” concept: Our DRINK® seeks people regular citizens, professional drivers to go about their normal routine as they usually do, only with a small advert of our DRINK plastered on the driver’s door of your car. The ads are typically MAGNET decals, also known as “MAGNET AD,” that almost seem to be painted on the vehicle, and which will cover any portion of your car’s exterior surface.

What does the company get out of this type of ad strategy?

Lots of exposure and awareness. The auto wraps tend to be colorful, eye-catching and attract lots of attention. Plus, it’s a form of advertising with a captive audience,meaning people who are stuck in traffic can’t avoid seeing the wrapped car alongside them. This program will last for 6 months and you can decide to extend your contract after the initial 6 months.

You will be compensated with $300 per week which is essentially a “rental “payment for letting our company use the space no fee is required from you. Our DRINK shall provide experts that would handle the advert placing on your car. You will receive an upfront payment of $300 inform of check via courier service for accepting to carry this advert on your car. to this effect you are advise to check your email regularly to get update as to know when your upfront payment will arrive along with Graphic Artist address.

1) You will receive a Certified Check. As soon as you receive the check, you will cash the check for the decal wrapping on your car, deduct $300 as your up-front payment. The rest of the funds should be transferred to the Graphic artist that will wrap the decal on your car. All you need is to confirm the acceptance and understanding of this email.

2) You will make a transfer of funds to the Graphic artist at the nearest Walmart outlet in your area, the Info which you will make the transfer to will be emailed to you soon.

3) We’ll like to have some Information about your car.

i) Type of Car and Color

ii) Model/Year :

iii) Present Condition and the Mileage:

Applicant information:

Full Name:

Full Contact Address:

City, State, Zip code

Phone Number:

Note: Please, confirm that you did receive this message so that we can process funds that would be sent to you for the car advert.

It is very easy and simple, no application fees required. Get back with the above details if you are interested in this offer.

All other instructions will be sent out to you ASAP.

I……..Confirm to have received this email and understand the content.

Best Regards

________________________________________

From: Shauna

Sent: Tuesday, November 24, 2020 5:03 PM

To: kaka morufu

Subject: Re: Y35FV MILLER LITE VSP

I sure would allow you to paste your advert on my vehicle for $300 every week. I’m a Miller Lite beer fan anyway. Thanks for contacting me. I’ll be waiting for your response. Shauna

Virus-free. http://www.avast.com

On Wed, Nov 4, 2020 at 10:03 AM kaka morufu wrote:

MILLER LITE BEER would like to paste our advert on your vehicle while you make $300 every week for that.

Let us know if you are interested

Sent from Outlook

My friend got this exact scam about a week ago so around the same time as you. Same amt of money, same Spinx company. Same offer- a different beer, but $300 a week. Did you get this offer off of FB Marketplace? That’s where he did. What happened to him is they told him to meet them at a car wrap location. So he went to a local car shop- met a man with a Spinx logo office shirt on, and did paperwork and gave the man the money. When I looked it up I have never seen anyone meet someone in person to hand off money- I had only seen people asked to wire money!! He left his car, but when he came back it had been towed- by the actual car shop owner who was not part of the scam- just wondered why someone left their car on his lot an extended time period. My friend isn’t getting on top of it and reporting it- so I wanted to get the word out that a scammer went as far as to meet in person at a car shop with a company logoed shirt (Spinx)!

THANKS FOR THE INFORMATION; I THOUGHT IT MIGHT BE A SCAM. GLAD I

DID SOME RESEARCH;

MERRY CHRISTMAS & or

SEASONS GREETINGS!

Sincerely,

Your Average Joe.

I’m 60 poor yet humble now because of this horrific scam I had never heard of I owe my bank 2980.00

Got a check for over $2600.00 today for a NOS wrap. This person didn’t ask anything about my car it’s beat up. I don’t go anywhere less than 2 miles to grocery store and back. Thinking those are important question to ask before sending a check. So I new something was fishy, email NOS last week. They said scam. I need money so bad but I’m not that stupid. I did my research. I’m a single mom unemployed trying to make some cash and these assholes are ripping people off. I want to get these jerks. How do I scam them back. Legally of course?!?!

Pissed off Mom!!