Even though it’s been a while since my car wrap scam posting of 2013, I see that fake check scammers are still going strong.

Yesterday was a “red letter” day for me; I received not one, not two, but three fake checks in my mail box.

Fake check scam #1: Mystery Shoppers Agent

The first fake check scam involves mystery shopping through the company website Mystery Shoppers Agent.

At first, I wasn’t sure if this company was also a scam or just caught up in the cross hairs of the scammers’ ploys. You see, when it comes to fake checks, scammers don’t hesitate to “plug” legitimate businesses into the mix. Completely legitimate banks and retailers will appear to be sending cashier’s checks, and USPS or FedEx envelopes will feature actual return addresses.

In the case of Mystery Shoppers Agent, however, the stench of scam was almost immediately apparent. Aside from the site’s broken English, it states that it offers a “Minimum amount for each assignment is $600 USD, payable by check.” Also, on its application page, you find the following statement: “We would like to inform you that you will be handle two assignment per week and the minimum payment for the each assignment will be $600 which make it $1200 every week.”

I’ve been a mystery shopper since 2010; several of my friends have been mystery shoppers for 10+ years now. No one in my immediate group has ever heard of assignments paying $600.

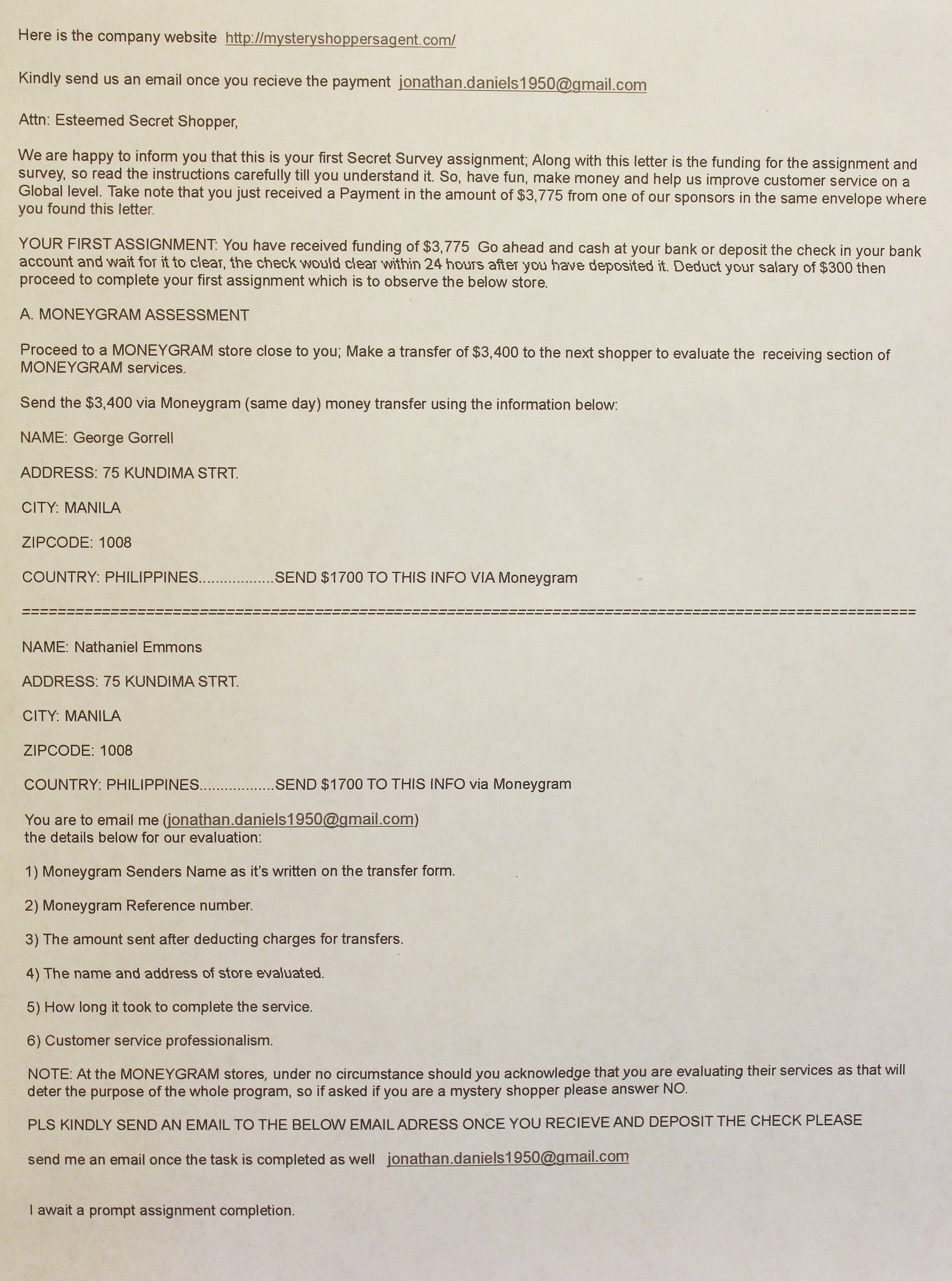

Also, for high-paying assignments of $60 or more, mystery shop assignments came with pages upon pages of instructions. However, read the letter I received and posted below for an assignment that supposedly pays $300:

For this “assignment,” you are requesting wire transfers to two individuals living in the Philippines. You are then generating a report about the “customer service professionalism.” No directions are provided on how to generate this report.

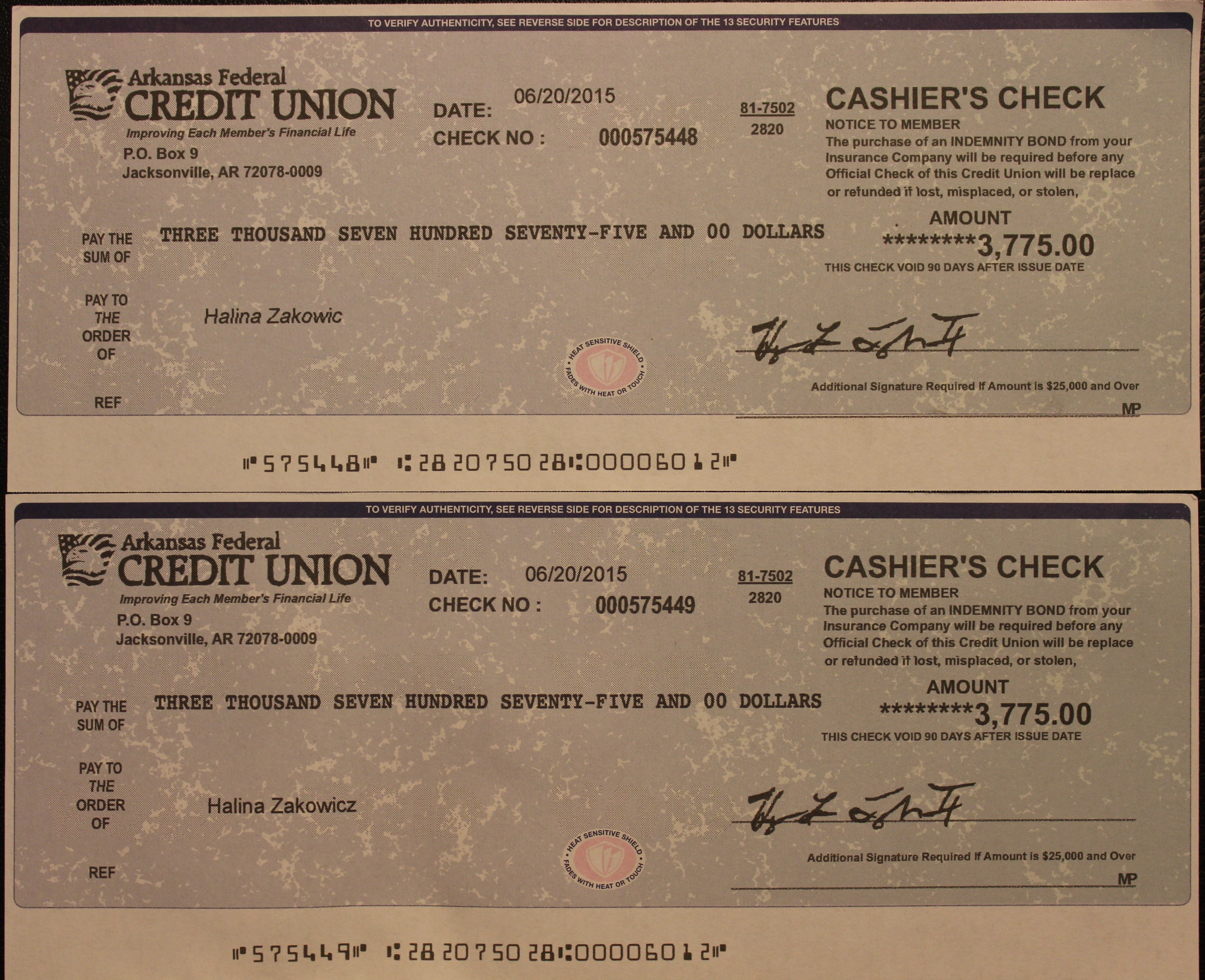

But it gets even better- I received not one such letter from Mystery Shoppers Agent, but two! In one day, I found the exact same letters addressed to me and sitting in two identical 2-Day Priority Mail USPS envelopes. Along with those two identical letters were these two identical $3,775 checks:

The same day, I also received the following email from Jo.DanieLS@Kash.info. His questions and my replies are posted below.

> Subject: First Task

> From: Jo.DanieLS@Kash.info

>

> First task is to be delivered to your address today or Tuesday at the latest and your assignment info and instructions would come in the mail along with your salary,please kindly follow the instructions that came in the mail along with your Paycheck…Did you recieve the payment yet?please reply back…thanksOn Mon, Jun 22, 2015 at 4:23 PM, Halina Zakowicz wrote:

Yes I did.From: jonathan.daniels1950@gmail.com

did you made the deposit yet and when would u send the funds?On Mon, Jun 22, 2015 at 4:26 PM, Halina Zakowicz wrote:

I deposited the funds this afternoon.From: jonathan.daniels1950@gmail.com

when would u send the funds?On Mon, Jun 22, 2015 at 4:38 PM, Halina Zakowicz wrote:

I’m going to do it later this week. Probably Friday.From: jonathan.daniels1950@gmail.com

why friday?the check would clear tomorrow…so you should send the funds tomorrow please…also,i have been calling you and you didnt pick your calls

What I found interesting was that never during our email interchange did “Jonathan” ask about the actual review that I was hired to complete. No, it was all about sending the money ASAP.

Two days later, Jonathan was texting me about the money. I’ve copied our conversation below and highlighted my answers in green:

Have you completed the assignment. Please reply now

Yes

Can I have the details for the assignment the ref no for each name

Hello Why did you stop replying

The first number 65189544

I got the first number. I hope you sent the funds to the new details I sent to your email please ?

I called moneygram. It says the first number is invalid

Sorry about that. Let me check

And why are you not picking up your calls? And what’s the ref no for the second one What’s goingon

Ok, I need to check with moneygram again about those numbers.

You are a liar. Why are you lieing ?

You can’t even pick your calls. You didn’t even send the second number. This is bad of you

Please check this link

Which link

Tinyurl.com/p77xuoy

Stupid woman

I’ve also filed this scam with the FTC

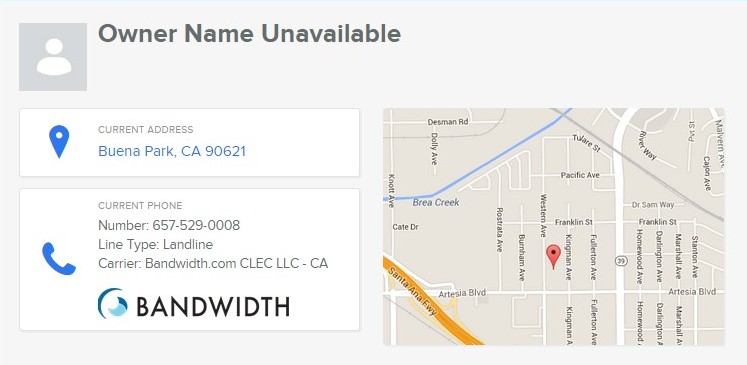

I should add that the phone number of this California-based operation is (657) 529-0008. If the “business” is based in California, why are the checks originating from Arkansas? And also, why are the USPS envelopes coming from New York & Company at 2655 Richmond Ave., #1070, NY, NY 10314?

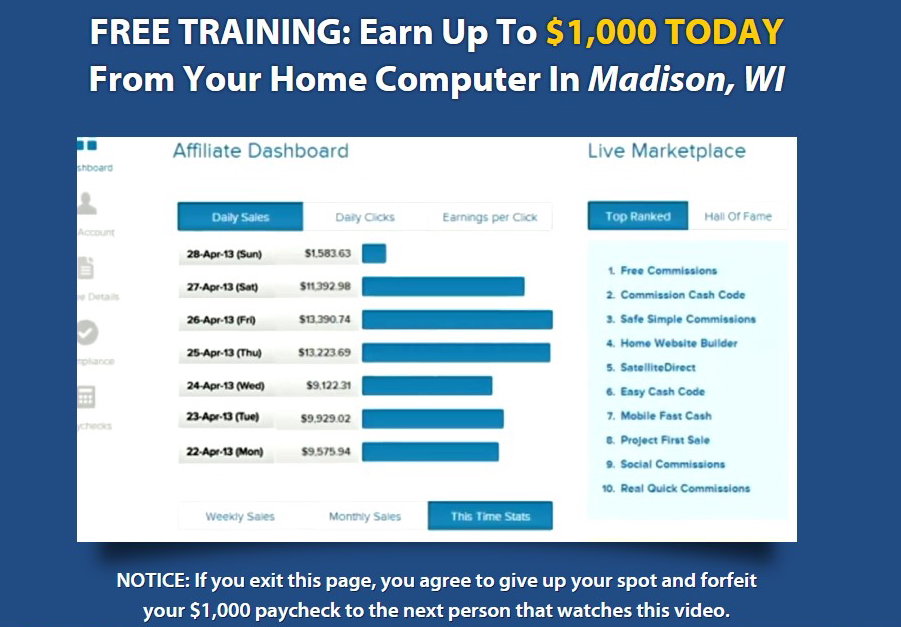

Fake check scam #2: Walmart Money Transfer

The other fake check scam came to me courtesy of “Joshua Baumfeld” of Secret Shopper. The email that I first received from this Joshua went as follows:

Dear Secret shopper ,

This is an update on Your first secret Shopper assignment which has been mailed and will be delivered today or latest tomorrow via USPS.Your secret shopper assignment will be done at any nearest Walmart store close to you,which will include shopping and testing other services available at Walmart.

Instructions on how to proceed and email your first assignment report has been included along in the packet.

Kindly notify and verify that you have received this email,and also notify via email as soon as you have received the assignment.

Regards,

Joshua Baumfeld

Head of Recruitment.

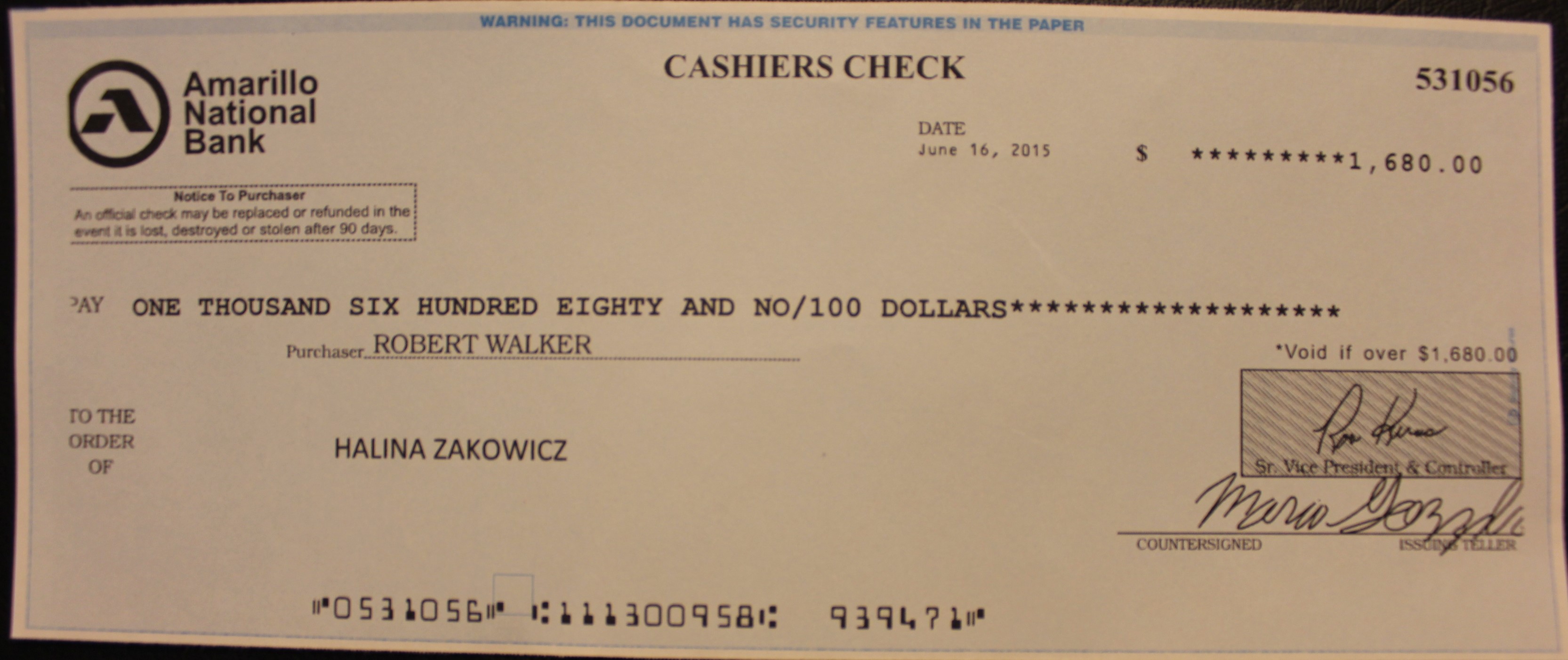

About a week later, I received an official-looking 2-Day Priority Mail USPS envelope containing a letter and a $1,680 cashiers check.

Joshua wanted me to deposit this check and then make a “Walmart to Walmart Money Transfer.” I was also supposed to report on such details as “smartness of the attendant(s),” “reaction of personnel under pressure,” and “rudeness and agents inefficiency to customers.”

There are many obvious red flags in this letter, including poor English, sketchy directions and a payment of $200 before I even do my job. Another point of concern is the state (Grenada) and city (Mississippi) names being reversed. Meanwhile, the address on the envelope states that the correspondence is originating from Joshua Baumfeld, 7072 Wnchester (typo included) Rd., Memphis, TN 38125.

Finally, Walmart has stated that it doesn’t engage in any Secret Shopper services.

The entire contents of my letter and check are provided below.

What is the point of these fake check scams?

When you receive a fake check from scammers, the point is to have you deposit that money into your bank account- and then withdraw or wire most of it to the scammers (or their associates). The deposit and withdrawal must be completed within 1-2 days or ASAP.

By doing so, you and your bank won’t catch onto the fact that the check is actually fake and will bounce in roughly 3 days.

By the time your deposited check bounces, the scammers will be long gone, as will your withdrawn or wired funds.

If you don’t yet believe me, please click on the following list of complaints from duped secret shoppers.

The lesson to be (hopefully not) learned here: Don’t fall for these fake check scams.

Bonus: Halina’s fake check collage

I just wanted to show off my assembled collage of fake checks to all our I’ve Tried That readers. In total, I’ve received $21,835 now in fake check money. Woo! Also notice that some of these checks are made out to my cohort Hugh G. Rection. I’m sure my mail carrier was highly amused.